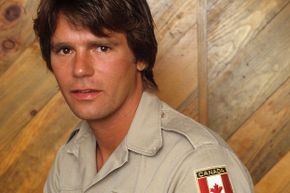

As far as the writers of the TV series "MacGyver" were concerned in the late '80s, a bar of chocolate could stop a sulfuric acid leak -- and as it turns out, they were right. Sometimes, the easiest solutions are right in front of us, with simple tools and uncomplicated methods.

Despite our desire for ease, studies show that in the long run, we may be able to make ourselves smarter by doing things the hard way. What researchers have found is that every time we learn a new skill, solve a problem or complete a task that needed to be thought through (for example, planning your route rather than relying on your GPS mapping program to do it for you), you're boosting your working memory. That's all well and good, but what's the point of taking the hard way to, say, tear into a knotted bag of take-out? There's a part of all of us that sometimes just wants to take the easy way out, the chocolate bar way out, especially when it comes to things like figuring out the tip and untying knots. Here we have a list of tricks that would make MacGyver proud, or at least keep you from tripping over your untied shoelaces. Let's begin with how to get into that take-out bag.

Advertisement